Registering for self employment and other considerations

Self employment and being your own boss

Registering for self employment. Enough is enough. You have decided, for whatever reason, that you have had enough of slaving your butt off in order to keep your employer in their lavish lifestyle whilst you struggle to make ends meet, and that you want a piece of the action. You know you are good at what you do and you have loads of ideas but your employer won't listen to you and you are being held back. You know you can go it alone and be successful and have decided to take the plunge and go self employed, but you don't know what to do next. Is self employment really for you, and if it is, just how do you put your plans in to action? For some information to set you off in the right direction read on........

Registering as self employed

When you take the plunge and go self employed you have to register as self employed. A sad fact of life is the taxman will always get his cut of our income and in order to ensure you are paying your taxes the taxman needs to know all about your income and your employment status. So, one of the first things you have to do is register for self employment and inform the taxman.

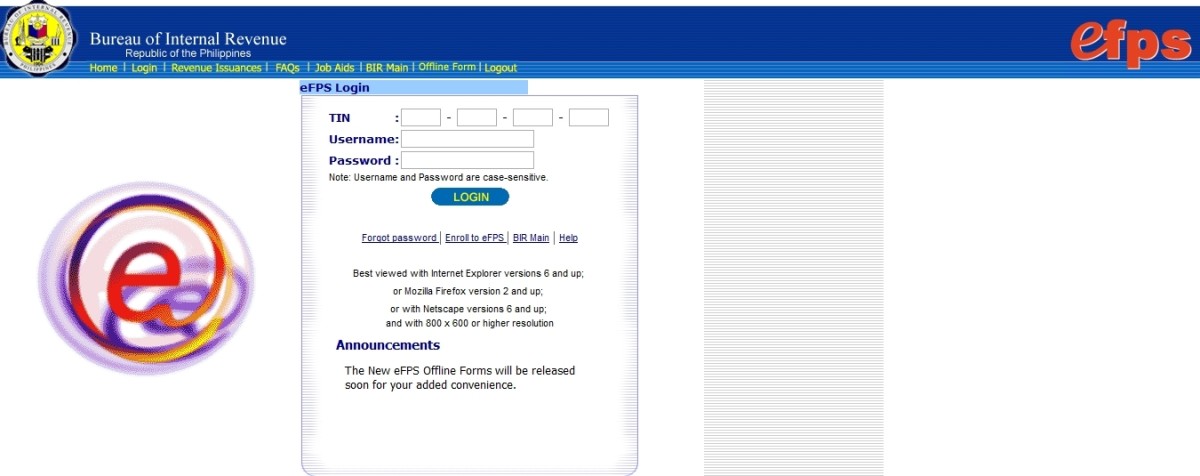

Different countries around the world have their own tax rules and regulations therefore the procedure of registering for self employment will vary. That said, registering as self employed won’t be a difficult task, wherever you live. If however, you do get stuck there will be plenty of help and assistance available to you. You could pay an accountant or tax adviser to register you as self employed, alternatively you may go on your local tax authority’s website where you will find out everything you need to know and the best bit is, it won’t cost you a single penny.

In the UK, registering for self employment is a quick and easy task and requires completing a single form that covers two sides of A4 paper. The form you need to complete is called Form SA1 and is available as a direct download from HM Revenue & Customs website. When you download the SA1 you can also download a set of guidance notes, although in reality to you won’t need them since the form is self explanatory.

Form SA1 asks for basic information such as your name, address, National insurance and other personal details and the reason why you need to register for self assessment. Simply complete the form, sign and date the declaration before posting it off to HM Revenue & Customs and in a few days you will be in the self assessment system and have your own ten digit Unique Taxation Reference “UTR” number. And that’s all there is to it. Filling in a simple form and you are now officially in the self assessment system and registered as self employed.

Tax issues for the registered self employed

When you commence self employment your tax status changes and the way you are taxed changes. If you are an employee you are taxed under the Pay As You Go “PAYE” scheme, which is where you suffer payroll taxes. Under this scheme your employer has an obligation to calculate your tax liability and pay it over to the tax man on your behalf. Your employer also deducts national insurance contributions and pays them over to the department of social security. An employee who receives income over and above their salary will have to calculate the additional tax themselves and pay it over to the taxman.

A self employed person does not have an employer therefore they are responsible for calculating their own tax liabilities, as well as paying them over to the tax man by the due dates. A self employed person is taxable under the Self Assessment “SA” scheme and when you register for self employment by completing Form SA1 you are automatically enrolled in to the self assessment scheme.

The UK tax year runs from the 6th of April to the 5th of April. Paying UK tax is quite difficult to get your head around and is far more complicated than it should be. The income tax is paid in three instalments.

The first instalment is a payment on account that is payable by 31 January before the start of the tax year and the amount is half of the previous year’s tax liability. In the first year of self employment there is no payment on account in the January, although there will be for the second year and every year thereafter.

The second instalment is another payment on account that is due by the 31 July during the tax year. This instalment is also half of the previous year’s tax liability, so in the first year as a self employed person this payment is not due.

The third instalment is the balancing payment and is the total liability less the two payments on account. If the payments on account exceed the total liability HM Revenue & Customs will refund the amount. If the total liability exceeds the two payments on account the excess has to be paid over to the taxman.

The above is best explained by way of an example. So, let’s look at the tax year ending 5 April 2011, where the tax liability is £12,000. Let’s say the 2009/10 tax liability was £10,000. So, for the year ending 5 April 2011 the first payment on account of £5,000 (being £10,000 divided by 2) was due by the 31 January 2011, the second payment on account of £5,000 (being £10,000 divided by 2) was due by the 31 July 2011 and the balancing payment of £2,000 (being £12,000 less £5,000 less £5,000) is due by the 31 January 2012. It should be noted that the first payment on account for the 2011/12 tax year is also due on the 31 January 2012, which is an amount of £6,000 (being £12,000 divided by 2).

A self employed person is also liable to national insurance contributions in order to retain their right to state benefits, such as the state retirement pension. A self employed person will pay a flat rate of £2.50 per week class 2 contributions. A self employed person also has to pay class 4 contributions, which are 9% of the annual taxable profits between £7,225 and £42,475, and a further 2 per cent on profits over that amount. Class 4 contributions are payable with the income tax.

Turbo tax for sale on Amazon

Being self employed will mean you will have to calculate your own income tax liability. You can use an accountant to help you, but this is going to be expensive. Alternatively, you can purchase some tax software such as Turbo tax. These programs are cheap, easy to use and could save you a small fortune in accountancy fees.

Other considerations before registering as self employed

Before registering for self employment there are other things you have to consider and be comfortable with, i.e. the advantages and disadvantages of self employment. Let’s start with the advantages of registering as self employed, which are as follows;

1) A self employed person can do what they want, when they want and how they want. There are no managers or superiors around to bark orders and dictate.

2) A self employed person can take time off whenever they want and not have to work around fellow work colleagues, month end procedures and other work commitments.

3) All the money a self employed person earns is theirs to keep. Employees earn a salary and no matter how much money they make the will receive the same amount each and every month, with any extra lining the pockets of the boss.

4) A self employed person determines the future of the business and has total control.

The above is not an exhaustive list of advantages and I am sure if you sat down and thought about it for a while you would think of many others.

Now over to the disadvantages of registering as self employed, which are as follows;

1) A self employed person is not guaranteed income. If the work isn’t there the money won’t be earned. Compare this to an employee who will receive a salary regardless of whether the work is there or not.

2) A self employed person does not get paid holiday. Compare this to an employee who gets a specific number of days annual leave, all of which are paid.

3) A self employed person does not get sick pay. Compare this to an employee who will get paid for periods of absence from work through illness.

A self employed person has to take out several insurance policies to cover themselves in tough times or times of sickness. Regardless of whether you are employed or self employed, the bills still need to be paid.

Once again, the above is not an exhaustive list of disadvantages and I’m sure if you sat back and though for a while you would come up with several more.

Before deciding to register as self employed you need to note down all the advantages and disadvantages of self employment and make an informed decision. If the advantages you identify outweigh the disadvantages, then by all means go for it. However, if the disadvantages you identify outweigh the advantages you need to tread carefully and proceed with caution.

Is registering as self employed for you?

So, is registering as self employed really for you? The answer to this will vary from person to person. Before jumping in with both feet and registering as self employed it is important to take a step back and weigh up the advantages and disadvantages, as well as the pros and cons, of self employment and then make an informed decision.

Self employment books to buy on Amazon

Regardless of how skilled you are, or how good you are at your job you will need some business acumen when you register self employed. You could enrol on a course at a local college, which is going to cost you, or you could simply purchase some books and do your own research at your own pace and time. Here we have a selection of business books that are going to help you on the right road.

How to register as self employed - by HM Revenue & Customs

Need some more tips and advice on how to register as self employed? Check out the details from HM Revenue & Customs, the professionals.

Accounting software packages for sale

When you are self employed you will be taxed under the self-assessment regime, which means you have to deal with your own income tax affairs. As a self employed person you are assessed on the profits your business makes, therefore you will have to prepare some accounts. You could employ an accountant to prepare your accounts or you could save yourself some money and buy some accounting software. This accounting software also doubles up as a cashbook so you won’t need to write up your cashbook manually.

There are many good accounting packages for sale, although the better ones are Quickbooks Pro and Sage Peachtree, and what better place to look for buying an accounting package than Amazon.

Manual cashbooks for sale

If computers are not your thing and you prefer to keep your business records and manually write up your books, you are going to need some ledger paper or re ruled and printed cashbooks. Here we have a selection of cashbooks that would be ideal.

Raising finance to go self employed

In order to go self employed you are going to need some money behind you. If you have a large redundancy payout or some savings, then all well and good. But what about if oyu don't have any money behind you? What then?

Fortunately, there are many ways to get finance to fund a new business venture, such as going self employed. For some great tips and advice make sure you check out this video footage.

It's over to you!

Registering as self employed and going it alone is a daunting experience and quite risky. Would you ever do it?

Would you ever go self employed?

Office furniture for sale

You are going to need a home office regardless of your self-employment’s activities, which is going to require some specific office furniture and Amazon is a great place to buy from. When you buy any office furniture remember to keep the receipt as you can claim some tax allowances for all capital purchases.

Filing and storing solutions for sale

When you become self employed you are going to have to be organised and make sure all of your paper work and records are in order. You need to remember the taxman can go back several years and open an enquiry in to your tax return so you need to make sure you keep all your financial records safe. In order to keep you paper work safe and in order you are going to need some storage solutions, such as a filing cabinet, and Amazon is a great place to start looking.

If oyu have any thoughts, comments or anything else you want to get off your chest, please feel free to do so in my guestbook

![[Old Version] TurboTax Deluxe Federal + E-file + State 2011 for PC [Download]](https://m.media-amazon.com/images/I/41vdnwn1qlL._SL160_.jpg)

![Sage Peachtree Complete Accounting 2012 [OLD VERSION]](https://m.media-amazon.com/images/I/51B+3D2Q4fL._SL160_.jpg)